The corrugated cardboard market

In the Spanish economy, the packaging sector is of great importance. Corrugated cardboard is one of the most used materials in the world to group, store, transport and sell consumer products. This product arises as a result of the evolution of wooden packaging. Instead of directly using boards joined together by nails, it was devised to convert the shredded wood into paper coils and alternately glue together corrugated papers with planes to obtain a plank. In this way, a cheaper material was obtained and, above all, with better functions and more benefits than wood.What is corrugated cardboard?

Corrugated cardboard consists of the alternative union of flat and corrugated papers to form sheets. In this way, different types and thicknesses of plate are obtained depending on the number of smooth and wavy faces glued alternately. In addition, the range of materials must be taken into account depending on the quality and weight of the papers that are combined. The corrugated cardboard sheet is manufactured in a machine called a “corrugator”. Machine that, using paper and adhesive, forms the corrugated cardboard sheet thanks to the action of steam and heat. Once the corrugated cardboard sheet is obtained , the packaging is manufactured in the different production lines.Main companies in the Sector.

Based on turnover volume , the main companies in the sector are: - Smurfit Kappa. - Saica packaging - International Cartonage (CARTISA)Subsectors that make it up.

The E+E (container and packaging) sector in our country integrates eight subsectors: plastic, corrugated cardboard, glass, cardboard, containers made of more than one material, metal and polystyrene.History of the sector

Throughout history there have been a multitude of containers and packaging depending on the materials and means available. From plant resources such as wood, to the plastics that we know today. In any case, it has always been necessary to have containers and packaging to contain, store, transport and sell products. Until the end of the s. XX, the general use of packaging made of wood, wicker, esparto grass, etc. predominated. whose preparation was produced in an artisanal way. In the development of containers and packaging there has been a transcendental fact: the transition from bulk sales to packaged, labeled and packaged products. In such a way that anonymous products are no longer marketed, but rather products with commercial brands. The origins of corrugated cardboard date back to 1856 and are officially recorded in English patents, in the form of a corrugated material for lining hats. However, as a packaging material, it was in the United States, in 1871, where it was patented as a corrugated material for packaging vials and bottles. In 1881, the American Robert H. Thompson built the first mechanical corrugating machine, and corrugated cardboard was manufactured as we know it today. The first data on the origin of corrugated cardboard in Spain is from 1908 and is due to Juan Sans (Papelera Española del Prat de Llobregat in 1946). It is therefore the first manufacturer of corrugated cardboard packaging in Spain, bringing the sheets from France. Later, in 1922, the first corrugating machine was installed in Barcelona.Distribution channels.

The corrugated cardboard packaging market has had a slower pace of adaptation to changes in market structures and this is due to several reasons. Until now there has been no need to compete as other market sectors have been forced to. The fundamental cause has been a supply of packaging that is less than or equal to demand, in such a way that everything produced is sold in advance. In fact, the manufacturing of the product is always made to order and to measure, except for some standardized packaging for general uses. Another reason is that it is always behind the products sold by the packaging consumer company, which is why the manufacturer is forced to be cautious and not exceed production. Therefore, the evolution and development of companies in the sector go through immediate adaptation to the market. As society has become industrialized, many factors in the distribution chain have changed. The following graph shows the relationship between the raw material extractive industry as a supplier to the corrugated cardboard manufacturer. And in turn, the latter provides consumer companies with packaging to satisfy the needs of said business organizations.Main changes in the Sector.

Due to continuous industrial development and growing consumption, it has led to a progressive shift from wooden packaging to corrugated cardboard; because of the advantages that the first one had. The main advantage is the material that, even if it is wood pulp, straw, etc. saved on raw materials. It is cheaper, takes up little space, absorbs vibrations, shocks and impacts well, weighs little, etc. And it also has the advantage of being recycled after use to become paper again. On the other hand, it is worth noting that another change in the sector has been the speed of production, which has multiplied by more than a hundred since its origin. These increases in speed have been linked to technical improvements in cutting machines and the advancement of materials. There are also changes in the economic field, such as the discrimination that existed in the US between corrugated cardboard packaging and wooden packaging, which ended with the elimination of the taxes imposed on the former. Now, perhaps the most surprising development in the evolution of corrugated packaging occurred during World War II, with the so-called “V boxes.” Where the superiority of the material was demonstrated, being more compact than the other containers, thanks to the anti-humidity treatment of the cardboard that made up the boxes. This fact overcame the resistance and prejudices that the American Navy had about cardboard packaging.Analysis of billing, market shares and sector profitability.

Corrugated cardboard is one of the most used materials in the world; In Spain it occupies eighth place in the classification of economic sectors and fifth in Europe. As we have said previously, the packaging materials sector is made up of eight subsectors. Corrugated cardboard accounts for 23% of the global sector in terms of turnover. The plastic subsector is the one with the highest business volume, which as a percentage represents 31% of the sector's total, and metal and glass containers, with 15.5% and 13% respectively. The cardboard and complex packaging industries account for 19% of the sector's turnover, and transport packaging accounts for 1.6%. The following data highlight the importance of the Spanish corrugated cardboard industry:ENVIRONMENTAL FACTORS THAT AFFECT THE CORRUGATED CARDBOARD MARKET: THE MACRO-ENVIRONMENT

A. Social

As we all know, marketing develops a set of actions that are aimed at knowing the consumer's needs and satisfying them. From a marketing perspective, the consumer is the “king”. Their needs dictate the services and consumer goods that companies must produce. Now, we must take into account that the market is something alive, and therefore, in constant evolution, and that the needs of the consumer are modified or change as technological advances, development, education, fashions do. , etc. If the company wants to be successful, it must be aware of these changes and prepare the appropriate strategy for the new situation.Consumer company

The consumer of corrugated cardboard packaging, containers and cases is the company, whether state-owned or private, regardless of the sector to which it belongs. The consumption of packaging is something inherent to products, goods or services and consequently a primary need for any company that needs to pack, store, transport and sell consumer goods. The graphic and structural design for cardboard containers and packaging is at the service of the consumer company and the manufacturing company. The professional activity of designing corrugated cardboard containers and packaging is aimed at solving the problems and needs of creating new systems and types of boxes, optimizing packaging manufacturing processes, improving packaging systems and rationalizing the packaging system in line with the needs to be satisfied in the market. All this taking into account current regulations and legislation, as well as technology, storage and transportation systems, logistics, and Marketing techniques to obtain good results in marketing, promotion, sale, consumption and recycling.B. Political

If we take a brief review of the evolution of the so-called industrialized countries, we can see how in the different stages natural resources have been used for their subsequent transformation into consumer goods, without taking into account regulations that preserve the Environment. Since the Industrial Revolution began, based on the steam engine applied to textiles and the steel industry with coal as an energy raw material, driven by technicians and artisans. A second stage based on oil as a source of energy, and the combustion engine, the automobile, the organization of work; whose promoters were scientists and technicians. Until reaching a third stage, it is distinguished by nuclear energy, automation, electronic and chemical industries, a type of organization that takes advantage of computer techniques; driven by teams of highly specialized scientists and technicians. We have reached the point where consumption and oversupply in industrialized countries has been such that more waste and residue has been produced than nature alone can eliminate. Faced with this abuse, which is deteriorating the Environment by leaps and bounds, there has been a logical reaction to counteract the effects of pollution with a series of measures aimed at alleviating the deterioration of the Environment as much as possible. In Europe, Germany leads the environmental trend, both politically and industrially. So the EEC began to debate directives on the recycling of containers and packaging. “On March 21, 1985, a directive was approved in Brussels that could have considerable impact on the manufacturing and user industry of containers intended to contain food liquids. The Directive is called, “Directive on packaging of liquids intended for human consumption”. The objective of the Directive is: “to reduce the impact of liquid packaging for human consumption on the environment, stimulating the reduction of energy and raw materials in consumption.” The measures that each State must take may be: legislative, administrative or voluntary acceptance. And although there are many gaps in the provision, ultimately it is about: - Develop consumer education in favor of reuse, recycling and the elimination of urban and industrial waste. - Facilitate refilling and recycling. - Promote waste collection, selectively, and separate the different waste. - Promote the development of packaging, in such a way that the consumption of raw materials is reduced, helps the recycling of waste and saves energy. - Maintain or increase the proportion between recoverable packaging (that can be refilled) and recyclable.C. Environmental

Ecology:

What can we say about the meaning “ecology” used ad nauseam and used for the most varied interests, from politicians to intellectuals, from industrialists to consumers, and a long etcetera that ends in a disaster drawer where almost everything fits. Out of curiosity we have gone to the definition given by the Royal Spanish Academy where it says: "ecology. Science that studies the relationships of living beings among themselves and with their environment. 2. Part of sociology that studies the relationship between human groups and their environment, both physical and social.” Ecology has a great relationship with the corrugated cardboard sector, since it directly affects paper, as a raw material for the manufacture of the sheet, and the recycling of packaging once used. Fortunately, corrugated cardboard packaging is friendly to the environment, whether it is recycled to form new paper or taken to the landfill due to its biodegradable feature. It is also possible to use it as a source of heat energy, through combustion. On the other hand, there is no doubt that in these times we are reaching a collective awareness that nature is a common good that cannot be subjugated by industrialized societies to such an extent that the balances in the different ecosystems are broken. results so negative that they could turn against the entire population of planet Earth.Raw material

The raw material used to manufacture corrugated cardboard is paper, which in turn comes from wood, a renewable material found directly in nature.“The more trees we use, the bigger the forest is, something that may seem like a huge contradiction has been a reality for some time.”We can often hear arguments accusing the paper industry of causing irreparable damage to the environment. Nothing further from reality. The image that people's ecological awareness is creating of the serious problem of deforestation, whose most dramatic example is the disappearance of tropical forests, has nothing to do with the paper production industry. “Paper and cardboard consume only a tenth of the wood felled in the world. More than half of the felling is used as fuel and a third in sawn products destined for other industries (furniture, construction, shipyards, etc.).” The paper and cardboard industry mainly uses small wood, that is, leftovers from this third part mentioned above, and the wood obtained by cleaning or clearing the mountains. As logic indicates, the paper industry is very interested in maintaining its first source of raw materials: forests. The vast majority of European and American forests are protected by law. The Nordic countries are a good example of this because the strict legislation in force regarding logging and reforestation has meant that their forest area has doubled in 100 years. Only 70% of the annual increase is cut down, preserving the remaining 30%.

Recycle

Recycling paper and cardboard is a smart decision. Countries that act in this way denote a high level of civic and economic development. Today, the pressure on opinion caused by the serious problem of wastewater and its consequences for our Environment has radically changed the behavior of citizens in developed societies. What was previously considered waste is now a source of new resources that we must necessarily try to take advantage of in accordance with all the regulations on containers and packaging that have been published or are being prepared in Europe. “In this sense, corrugated cardboard offers an experience that has been developing for decades, even before there was ecological awareness. There is an entire paper recovery and production industry that emerged spontaneously using “paper” or “old paper” as raw material.D. Economic

The more advanced the technology and the cheaper the labor, the greater the supply on the market. And as a consequence , the lower the production cost, the greater the supply of products that are launched on the market. Production costs vary the price at which each product is offered. The main factors involved in production costs are: the salaries of the company's workers, raw materials, technological equipment and energy.E.Technological

Means, equipment and programs for structural design

With computer advances and the progressive application of computers to different industrial activities, programs and equipment have been produced aimed at computerized work in the graphic arts sector. In Europe and the US there are companies that have developed computer programs and equipment aimed at manufacturing dies. As we all know, dies are essential manufacturing tools for manufacturing certain types of boxes. These dies are of two types: flat and rotary. Until a few years ago these dies were drawn manually and sawed and assembled by hand. This meant slow, tedious, expensive work, with little precision in measurements and reliability in repetition. Currently there are computer programs and equipment with libraries of box types (FEFCO and ACME), which facilitate the entire process of design, drawing, plans and cutting of cardboard and wooden board prototypes quickly, accurately and reliably. However, the assembly of blades and splitting on the wood remains natural. These same computer equipment are used for structural packaging design since they allow not only to make the existing types in the library but also to mix or choose fragments of any type of box to make a new design, or to start from scratch and design non-existent types of boxes. .Technical department

Corrugated cardboard companies have a person dedicated to serving as a bridge between the commercial area and the production area. The mission of this job or technical department is to order and review the different tools for the manufacture of each of the packaging orders that are manufactured for the first time. As we all know, to manufacture packaging you need printing plates and dies if the process and type of box and conditioner require it. With the incorporation of graphic and structural design by computer in corrugated cardboard plants, the information can be recorded in a computer that serves to provide the development of boxes, measurements, plans, printing, die-cutting, statistical data, etc.; in a way that simplifies the work and offers fast and reliable information, not only to a department but to all those involved in the work team that intervene in the global packaging manufacturing process, both from the company itself and from the suppliers. of clichés and dies. In summary, the ideal type of technical department involves the incorporation of computer resources that allow the coordination, reception and sending of information from the different areas that come together in this department, that is, sales, commercial, design and relations with cliché suppliers. and dies.PORTER'S FIVE COMPETITIVE FORCES MODEL. KEY SUCCESS FACTORS. MICROSECTORAL ANALYSIS

A. Competition from substitute products.

As substitute products at the beginning of the invention of corrugated cardboard, we could count on boxes made of wicker, wood, metal, and esparto that were manufactured by hand. Currently, perhaps the most substitute products may be plastic boxes and bags, although with nuances since according to European legislation on recycling, the latter will tend to be eliminated from the market as they are not ecologically sustainable. For all these reasons, the corrugated cardboard sector currently has few substitute products, mainly due to the higher relative cost of substitute products, their relatively low availability both in supply and ease of transportation (plastic boxes are not foldable with ease), and the difficulty of change in the consumer who has become accustomed to the use of boxes made of corrugated cardboard.B. The threat of entry of new competitors.

- b1) The necessary investment in machinery, industrial warehouses, logistics warehouses, etc. for the start-up of production is high, which causes it to deter new companies from establishing themselves in the market

- b2) In this sector, economies of scale are taken into account, they are more efficient producing on a Large Scale. Even so, there are small manufacturers who agree to enter the market with a small scale and production and accept high unit costs since there is a niche of customers with specific needs or small orders in quantity of containers, who agree to pay a slightly higher price per it.

- b3) When the first corrugated cardboard factories were introduced in Europe, there was a First-Mover Advantage for 15 years in which there was no more competition. Nowadays this is no longer the case.

- b4) It is difficult for the client to differentiate the finished product, since the processes and raw materials used to manufacture the corrugated cardboard container are practically the same for all industries, so there is no manufacturer's reputation in this regard, although it does exist in other areas such as logistics, customer service, etc. of each competitor are very different from each other.

- b5) The degree of access to distribution channels is only given depending on the number of units that make up the order, since this sector is produced under customer demand.

- b6) At the beginning of the corrugated cardboard industry there was a regulation in the United States Railways against the use of cardboard containers to transport merchandise on trains, which until then was done in wooden boxes. The railroad association and the lumber industry association had a lot of power, but ultimately the corrugated cardboard producers won the battle against such counterregulation.

- b7) Retaliation by companies already established in the sector against new competitors may come from reducing packaging prices, in part, but above all if they are based on excess capacity, since in conditions where The cost of the raw material (corrugated cardboard) does not vary, it is more difficult for them to make a drastic reduction in packaging manufacturing prices.

C. Rivalry between established competitors.

In the corrugated cardboard market, historically the pace of adaptation to the different phases of structures has been slower. The cause has been a supply of packaging equal to or prior to demand, in such a way that what is produced is sold in advance, corrugated cardboard packaging is always manufactured to order and to measure, with exceptions. Furthermore, manufacturers were cautious with the structures and production capacity of their companies, so as not to compromise their costs due to excess production in situations of low demand, and this entails an immediate adaptation to the market that leads to lower costs, improved quality, etc. . That is why until now there was little rivalry. Recently and as a consequence of fluctuating situations of high demand, order delivery times have been extended and sales prices increased, which has caused an increase in corrugated cardboard manufacturers in the wake of the sector's profits, which in turn has caused an increase in competition and rivalry within it. We must take into account the following factors:c1) Concentration

In the following graph we can see the large number of competitors in the corrugated cardboard market, which provokes an aggressive pricing policy, with a large majority atomized, 41% of the competitors:c2) Diversity of competitors

It is true that there is little diversity of competitors as many have a very similar production structure in machines (corrugators), warehouses, processes, etc. The greatest differentiation is between the competitors that have their own corrugator and those that buy the plates already made from the corrugator manufacturers.c3) The degree of differentiation of the Product is low

The offer among competitors is very similar. It is the client who “gives shape” to the container under special orders, but all manufactured in the same way: clichés, dies, folding machines, etc.c4) There are high exit barriers

due to excess production in the market since the investment in starting up the factories is high, the assets (machines) must be amortized. Therefore, in excess capacity, prices tend to decrease if we only consider this reason.c5) Economies of scale are used very well

since the heavy initial investment in machinery and corrugators means that it is necessary to produce as much as possible so that the last unit of packaging manufactured is of lower cost (as the fixed cost is the same and the variable cost is the lowest among all production).D. The bargaining power of buyers.

The sale of corrugated cardboard packaging is part of the sale to producers, that is, the sale of industrial products to companies that produce or market other industrial or consumer products. This type of sale requires that the seller be an expert in the world of corrugated cardboard and must acquire training that can only be learned in the factories of the sector, from knowing the different types of papers that make up the most sophisticated sheet of cardboard that can be manufactured to the most sophisticated type of boxes that can be manufactured. Thus, the seller advises the client, takes measurements, recommends the ideal packaging, detects the problems that clients have with the packaging, etc. In general, what is sought in the sale of packaging is to satisfy the needs of the client so that they can, in turn, group, protect, store, distribute and market their products. Cardboard packaging is sold to companies and organizations for use due to: Logistics, Legal Framework, Internal Use, Market... The sectors to which most corrugated cardboard containers and packaging are sold are those related to food, agricultural products, beverages, tobacco, cosmetics, cleaning and household products, technological and electrical equipment, industrial products, etc. It is a sector that is quite sensitive to price, for several reasons: - It is usually one more component of the final product, which although on many occasions it must have an attractive design, on other occasions it is only a mere protector of an interior product intended for sale. - Although it is a product that is not standardized (each client has specific needs in terms of packaging measurements, quality, design, etc.), it is true that the raw material is standardized and therefore some products do not differ from one another. others on equal terms. - There is great competition currently in the market due to excess supply caused by the decline in industrial activity due to the economic recession. - The quality of the raw material in the industry is currently very similar due to the standardization of the paper pulp manufacturing processes, which come from recovered (recycled) paper and new paper from wood fibers. Although it is true that there is a low concentration of buyers since each one needs specific socks and design, and currently there is a low existence of substitute products...the Bargaining Power of buyers is high due to: - The greater the order volume (purchases), a lower price is usually negotiated. - Buyers can have updated information on prices from other suppliers, easily and quickly. - There is a relatively low cost of replacing the supplier, the main problem for this is in the design, dies or special measurements that each client needs and that must provide all that information and initial cost to the new supplier. - Concentration of Suppliers: Associations like Calidalia (www.calidalia.com) make the power of buyers higher.E. The bargaining power of suppliers.

Corrugated cardboard manufacturers make a wide range of containers and packaging with similar characteristics, meaning that there are no major differences in the final product. Proof of this is that each packaging consumer company (buyers) has more than one supplier for the same packaging. In Spain there are a large number of manufacturers of corrugated cardboard containers and packaging spread throughout the country, both on the Peninsula and on the Islands, in this way the demand is covered by geographical areas and agricultural and industrial sectors. It would not be very competitive to send packaging from Seville to the Canary Islands, since there are plants capable of manufacturing the same packaging at different points. However, within the Peninsula there are cases of transporting packaging to clients who are more than 500 km away. The manufacturing of containers and packaging is made to order, with increasingly smaller quantities but with greater frequency, which obeys the trend of continuous supply or “Just in Time”, avoiding storage and stock for a certain period of time. There are several factors that determine the attitude of manufacturers or suppliers in the market: - The Price of Raw Materials : Paper, both recycled and obtained from trees, is a COMMODITIE, there are forests dedicated to the supply of raw materials for the manufacture of paper and manufacturers are grouped in Spain in the Association of Corrugated Cardboard Manufacturers . AFCO, to have greater bargaining power. However, corrugated cardboard has long ceased to be a commodity. Today, each product travels in packaging tailored to its circumstances. - Means of production and manufacturing technologies, geographical location of production plants, commercial margins, etc. Depending on all these factors, suppliers may have more or less power. Therefore, what allows a leader to sell at a higher market price is above all the reputation of having the fame and prestige of being the best in all the processes involved in the production, sale and distribution of containers and packaging.Political-Social-Economic-Technological Analysis

In Spain, the regulations on packaging are included under the UNE regulations (A Spanish Standard), a set of technological standards created by the Technical Standardization Committees (CTN), made up of AENOR, manufacturers, consumers, administration and research centers. Manufacturers are classified within the IAE with number 4731 (Manufacturing corrugated cardboard and its articles) and 4732 (Manufacturing other paper and cardboard articles and packaging). Recently, due to the strong economic growth of countries like China that require a large amount of raw materials to supply their industry, its price has experienced 2 price increases in the international market so far this year (November 2011). The sector is experiencing a historical moment where Ecology is gaining great importance, which has directly influenced the packaging market to such an extent that it eliminates a series of non-recyclable products and forces the use of other materials that are not harmful to the environment, is heading towards “sustainable packaging” that is made from sustainable, renewable, recyclable and biodegradable raw materials, this is largely true in the case of corrugated cardboard. The consumer is increasingly concerned about health, food safety and environmental protection issues, so the packaging must guarantee traceability, absolute hygiene and recyclability. Technology : Recently, the strategy of corrugated cardboard packaging manufacturers has focused on offering customers innovative solutions. The service activity has been gaining specific weight compared to pure transformation and, thanks to technology, the center of attention is no longer on the corrugating machine but in the design department, where the client's needs are analyzed and defined and where More efficient and less expensive packaging is achieved every day.SEGMENTATION MATRIX. ANALYSIS OF DEMAND IN THE CORRUGATED CARDBOARD MARKET

A. Identification of the key Segmentation variables. Decision on Segmentation criteria

As we have already mentioned, the demand for corrugated cardboard is produced mainly by companies that require them for internal use, logistics, market or legal framework, which constitute the Total Market that the sector supplies, and this is going to be our main area of activity. . We can classify the segmentation criteria according to:- Clients : We identified some segments that absorb most of the demand for corrugated cardboard containers and packaging, which are, according to their importance in their level of demand, from highest to lowest: Food and agricultural products, beverages, tobacco, cosmetics, cleaning products and home, audio, video and communication equipment, industrial products, electrical equipment, etc.

- Geographic Area : The most industrial areas demand a greater quantity of cardboard packaging.

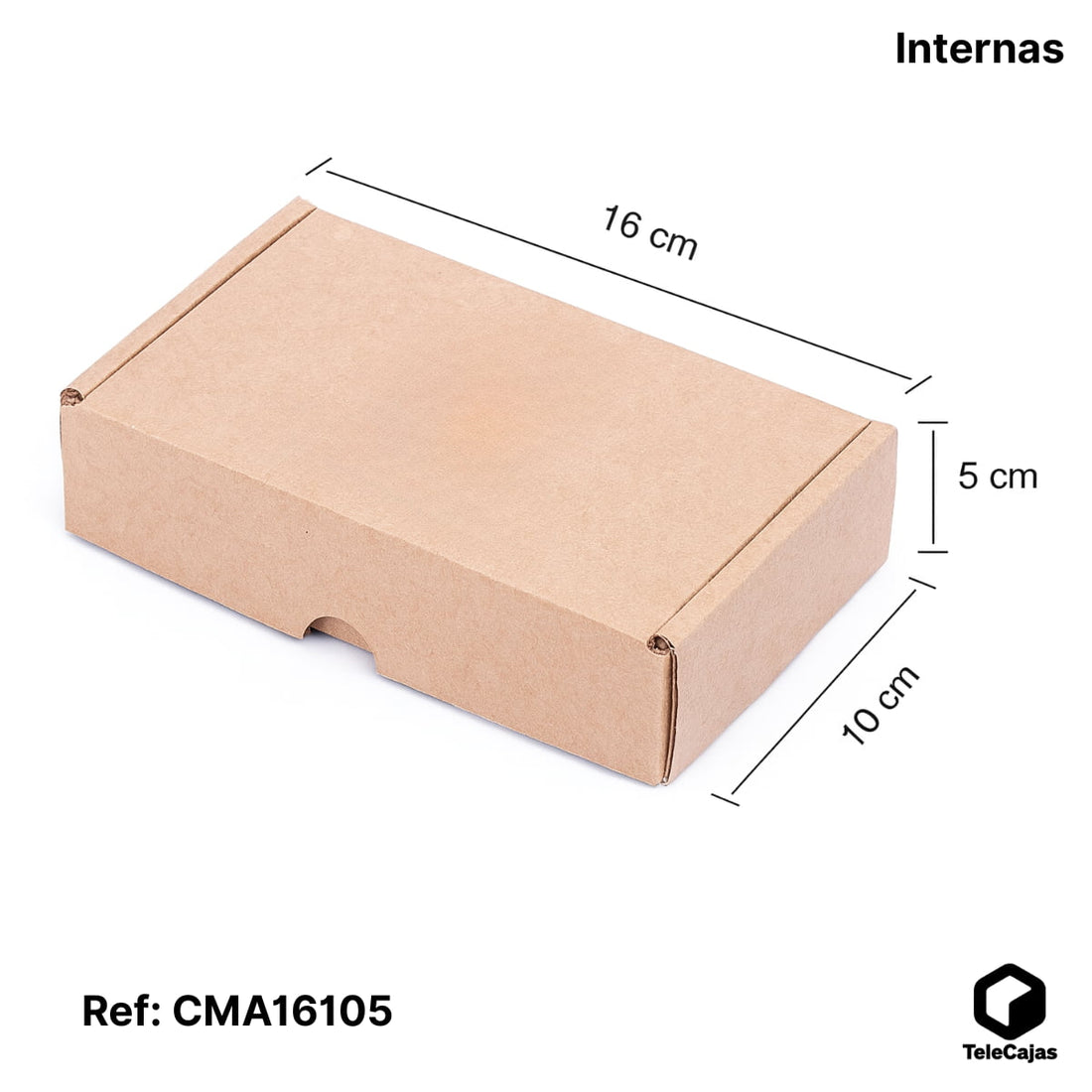

- Products : According to: quality, size, materials, design, color, warranty, etc. Certain sectors demand more highly personalized, visually attractive packaging (branding), which comes at a higher price and quality; while others require simple packaging to, for example, prevent breakage of their products until they are sold to final consumers. There are also sectors that do not require packaging but cardboard designs for use as displays at fairs, containers, creative uses such as shelves, cribs, chairs, etc.

B. Construction of the Segmentation Matrix.

C. Analysis of the attractions of Segmentation.

The development of new product lines in containers and packaging is essential for the survival and obtaining of profits by members of the corrugated cardboard sector. Hence the key role that graphic and structural design plays for this sector. The reasons are found both inside the company and in the environment, where the figure of the final consumer stands out. In addition to analyzing the threat of substitute products such as: Beverages in PET containers When analyzing the competition of a company, it is determined by 2 concepts:- Strategic groups : Group of companies in the sector with similar distribution, prices, products and communication policies.

- Barriers to mobility: Set of factors that make it difficult for a large company to move from one strategic group to another, segment to another. Ex: go from food E&E to moving E&E. The analysis of competitors focuses on: objectives and priorities, competitive advantages, that is, their strengths, and finally the weaknesses or vulnerabilities. As we have already mentioned, in this sector, sales are made at the request of each client, so the greatest attraction of segmentation will be to adapt as much as possible to the client's requirements.

D. Identification of the key success factors of the segment.

It is very important to identify the preferences of consumers in each segment to be able to adapt to what they want to buy, and to be able to enhance the competitive advantage in the segment in which we are strongest that can make us leaders at least in that segment. For example, as is currently happening, if we see a potential for increased sales, due to legislation regarding the gradual elimination of plastic bags, we should anticipate the markets by offering an alternative in corrugated cardboard packaging to serve said market. .E. Scope of Segmentation: Reduced or Expanded

In the strategic planning of the corrugated cardboard packaging business, we must decide which market segments we should enter and how to compete , and above all decide if we are going to focus on a large number of market segments and thus have a presence diversified (e.g. all types of packaging models adapted to each client according to their needs) or on the contrary obtain a relative advantage of specialization (make a certain packaging model for, for example, the fruit and vegetable sector (standard size container boxes for display in supermarkets). Focusing on a large number of segments will depend on:- The existence of similar success factors , for example in previous years or by observing the competition.

- The presence of shared costs taking advantage of Synergies

MAP OF STRATEGIC GROUPS. ANALYSIS OF THE CORRUGATED CARDBOARD MARKET SUPPLY

In this section we will try to achieve this objective through the identification of strategic groups. To do this, and by applying the Cluster analysis technique , groupings of the different companies will be made based on a series of variables that define the growth strategies developed. These groupings of companies will, therefore, make it possible to obtain strategic groups. The concept of strategic group is relatively recent, since it appeared in the seventies in a study on competition in the white goods sector in the United States carried out by Hunt (1972). The use of this concept quickly spread to the field of Industrial Economics and Strategic Business Management. The most used and named definition of a strategic group was set out by Porter (1979, p. 215): “ a set of companies in an industrial sector that develop similar behaviors along a series of key decision variables” . Furthermore, for other authors (Hatten and Hatten, 1987) the concept of strategic group is a good support tool that allows us to know the strategic behaviors of companies in a given sector by taking advantage of the available information. In general, strategic groups have three important characteristics:- Each group is made up of companies that follow similar strategies , based on dimensions or resources, as the case may be.

- Companies in a group are more similar to each other than those that belong to different groups, that is, internal homogeneity and external heterogeneity .

- Companies in a group are likely to respond similarly to environmental opportunities and threats.

Regarding the size of the companies, the corrugated cardboard industry in Spain is made up mostly of small and medium-sized companies, generally they are family businesses, distributed throughout the national territory, but with special concentration in the central, northeastern and east of the peninsula.

On the other hand, among the main sectors demanding corrugated cardboard packaging are agricultural and food products, with 23% and 16.5% of the total turnover value. Followed by beverages, with 15% and the processing of corrugated cardboard, with 10.6%.

In terms of innovation and development, this industry makes a great financial and training effort to ensure that its products are among the best in Europe, highlighting technological developments aimed at standardizing sizes and optimizing palletizing conditions. , transportation and storage.

Taking into account the R&D&I concept, the sector has obtained important results, specifically in the area of new products.

It is a sector that has to face a complex distribution , due to the disparity of destinations and clients, price instability in raw materials and demanding environmental, safety and hygiene regulations. Likewise, it must comply with the regulations required by the different industrial and service sectors for which the product is intended.

Selling, in general, entails a set of common activities; for each of the specific economic sectors, sellers with different characteristics and qualities are required. As for the training of the seller, it will depend on the type of sale that is going to be made. Sales can be to producers, wholesalers, retailers, special sales and other sales.

The sale of corrugated cardboard packaging is part of the sale to producers , that is, the sale of industrial products to companies producing or marketing industrial and consumer products. This type of sale requires the seller to assume the normal functions of any sale. From knowing the different papers that make up a sheet of cardboard to the most sophisticated type of box that can be manufactured. So much so, that the seller ends up being a specialist who advises the client, takes measurements, recommends the ideal packaging, detects the problems that clients have with packaging, etc.

In general, what is sought in the sale of packaging is to satisfy the needs of the client, so that they in turn can produce, group, protect, store, distribute and market their products.

Regarding the sales process , it occurs in a very peculiar way. The demand comes from companies and organizations that have to cover the needs of containers and packaging, however, they are not going to buy packaging but rather the commercial network of the “cartoneros” is going to sell them containers and packaging at home and to measure. This means that the sale of corrugated cardboard packaging is carried out at the headquarters or facilities of the consumer companies, upon request, with a specific delivery date, tailored and depending on the product and the stages of the total cycle of said packaging. with an agreed quality of cardboard, printed or unprinted, in the quantity indicated by the client and the merchandise packaged and palletized at a certain height and placed at a certain geographical point.

Corrugated cardboard manufacturers make a wide range of containers and packaging with similar characteristics, that is, there are no major differences in the final product. Proof of this is that each packaging consumer company has more than one supplier for the same packaging. The manufacturing of packaging is normally done to order, with increasingly smaller amounts but with greater frequency.

Considering the manufacturer's commercial policy, Spanish corrugated cardboard packaging companies are oriented towards sales; it is rare for there to be marketing departments in any of them. Therefore, the company's objectives focus on sales and the figure of the born salesperson.

There are several factors that ultimately determine the attitude of the different manufacturers with respect to the market, such as the price of raw materials, the means of production and manufacturing technology, general costs of the company, geographical location,...

Regarding the size of the companies, the corrugated cardboard industry in Spain is made up mostly of small and medium-sized companies, generally they are family businesses, distributed throughout the national territory, but with special concentration in the central, northeastern and east of the peninsula.

On the other hand, among the main sectors demanding corrugated cardboard packaging are agricultural and food products, with 23% and 16.5% of the total turnover value. Followed by beverages, with 15% and the processing of corrugated cardboard, with 10.6%.

In terms of innovation and development, this industry makes a great financial and training effort to ensure that its products are among the best in Europe, highlighting technological developments aimed at standardizing sizes and optimizing palletizing conditions. , transportation and storage.

Taking into account the R&D&I concept, the sector has obtained important results, specifically in the area of new products.

It is a sector that has to face a complex distribution , due to the disparity of destinations and clients, price instability in raw materials and demanding environmental, safety and hygiene regulations. Likewise, it must comply with the regulations required by the different industrial and service sectors for which the product is intended.

Selling, in general, entails a set of common activities; for each of the specific economic sectors, sellers with different characteristics and qualities are required. As for the training of the seller, it will depend on the type of sale that is going to be made. Sales can be to producers, wholesalers, retailers, special sales and other sales.

The sale of corrugated cardboard packaging is part of the sale to producers , that is, the sale of industrial products to companies producing or marketing industrial and consumer products. This type of sale requires the seller to assume the normal functions of any sale. From knowing the different papers that make up a sheet of cardboard to the most sophisticated type of box that can be manufactured. So much so, that the seller ends up being a specialist who advises the client, takes measurements, recommends the ideal packaging, detects the problems that clients have with packaging, etc.

In general, what is sought in the sale of packaging is to satisfy the needs of the client, so that they in turn can produce, group, protect, store, distribute and market their products.

Regarding the sales process , it occurs in a very peculiar way. The demand comes from companies and organizations that have to cover the needs of containers and packaging, however, they are not going to buy packaging but rather the commercial network of the “cartoneros” is going to sell them containers and packaging at home and to measure. This means that the sale of corrugated cardboard packaging is carried out at the headquarters or facilities of the consumer companies, upon request, with a specific delivery date, tailored and depending on the product and the stages of the total cycle of said packaging. with an agreed quality of cardboard, printed or unprinted, in the quantity indicated by the client and the merchandise packaged and palletized at a certain height and placed at a certain geographical point.

Corrugated cardboard manufacturers make a wide range of containers and packaging with similar characteristics, that is, there are no major differences in the final product. Proof of this is that each packaging consumer company has more than one supplier for the same packaging. The manufacturing of packaging is normally done to order, with increasingly smaller amounts but with greater frequency.

Considering the manufacturer's commercial policy, Spanish corrugated cardboard packaging companies are oriented towards sales; it is rare for there to be marketing departments in any of them. Therefore, the company's objectives focus on sales and the figure of the born salesperson.

There are several factors that ultimately determine the attitude of the different manufacturers with respect to the market, such as the price of raw materials, the means of production and manufacturing technology, general costs of the company, geographical location,...

COMPETITIVE ADVANTAGE OF THE LEADING COMPANY IN THE SECTOR

In all sectors there is a leading company that is the one that has the competitive advantage in said sector, the one that has the largest share of participation. The cardboard containers and packaging sector in Spain is distributed as follows. In our sector, the leading company is Smurfit Kappa , which we have already mentioned previously. We can say that a company has a competitive advantage when it has some differential characteristic with respect to its competitors, which facilitates the ability to achieve performance superior to them, in a sustainable manner over time. At Smurfit Kappa they consider that, being the leaders in the cardboard packaging sector, they can have a competitive advantage over other companies, which can be summarized in 4 areas:- Innovation and Design.

- Range of Exclusive Products.

- “A great team” of professionals in all areas of the business.

- Experience in Shelf Ready Packaging (SRP).

- Expand the total market : to do this you must carry out three strategies, attract new customers, discover and encourage new product applications and promote more intense use of your products.

- Protect market share : developing a strategy of innovation, fortification, confrontation or harassment.

- Expand market participation : this action must be well studied by the leading company, as it must assess whether obtaining the advantages it seeks outweighs the costs and risks that it entails.

Production, billing and consumption of the corrugated cardboard industry

Production, billing and consumption of the corrugated cardboard industry